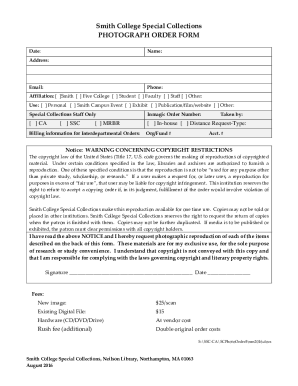

CO Denver Occupational Privilege Tax Return free printable template

Show details

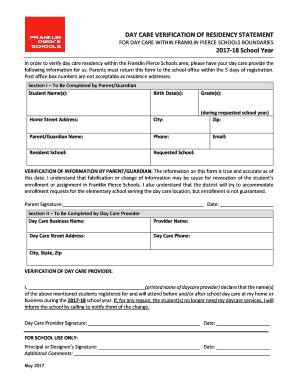

II. EMPLOYEE OCCUPATIONAL PRIVILEGE TAX are considered to only have employees not owners. Therefore all corporate officers meeting the earnings requirement in Denver should be included here. If any employee has another employer who is withholding this tax Form TD-269 must be furnished to the secondary employer verifying the primary employer is withholding tax. City and County of Denver Department of Finance Treasury Division P. O. Box 660859 Dallas TX 75266-0859 Denver Occupational Privilege...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ebiz denver form

Edit your denver occupational privilege tax return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your denver ebiz login form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing denver ebiz tax center online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit denver occupational privilege tax online form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ebiz denver login form

How to fill out CO Denver Occupational Privilege Tax Return Quarterly

01

Obtain the CO Denver Occupational Privilege Tax Return form from the official Denver website or your local tax office.

02

Fill in your personal information, including your name, address, and Social Security number or Employer Identification Number (EIN).

03

Indicate the quarter for which you are filing the tax return.

04

List the total amount of taxable income earned during the quarter.

05

Calculate the tax owed based on the applicable rates (currently $5 per month for employees and $4 per month for employers).

06

Complete any additional information required, such as exemptions or deductions if applicable.

07

Sign and date the return.

08

Submit the return by the due date, either online, by mail, or in person at the appropriate office.

Who needs CO Denver Occupational Privilege Tax Return Quarterly?

01

All individuals and businesses earning income within the City and County of Denver.

02

Employees who work in Denver and receive compensation.

03

Employers who have employees working in Denver.

Fill

denver ebiz tax login

: Try Risk Free

People Also Ask about denver opt login

What is Denver Occupational Privilege Tax on w2?

Denver occupational privilege tax The employee OPT is $5.75 per month. You will withhold this amount from each qualifying employee's wages. The business OPT is $4 per month per qualifying employee. Employees do not need to live in Denver to be liable for the tax.

What is occupational privilege tax Colorado?

Occupational Privilege Taxes in Colorado are essentially a “head tax” that is levied on most workers within jurisdictions that have the tax. Simply put, this means that every employee that falls under the requirements in the jurisdiction has to pay it, and there is typically an employer match of this tax.

Who is required to pay Denver OPT?

Occupational privilege tax Each taxable employee is liable for the employee OPT, which is withheld by the employer at a rate of $5.75 per month.

What is Denver City Occupational Privilege Tax?

Additionally, the employer is required to pay the business OPT at a rate of $4.00 per month for each owner, partner, or manager engaged in business in Denver regardless of how much they earn. The most convenient option to register for your tax license is online at Denver's eBiz Tax Center.

Who is subject to Denver OPT tax?

Businesses with owners, partners or proprietors engaged in business in Denver are subject to the business tax for each owner, partner, or proprietor even if that person pays the employee tax through an employer at a different job. The $500 earnings test does not apply to owners or partners since they are not employees.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit denver opt tax login online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your denver head tax to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit denver opt tax on an iOS device?

You certainly can. You can quickly edit, distribute, and sign denver opt on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Can I edit denver ebiz tax on an Android device?

You can make any changes to PDF files, like denver occupational privilege tax, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is CO Denver Occupational Privilege Tax Return Quarterly?

The CO Denver Occupational Privilege Tax Return Quarterly is a tax form that businesses and individuals in Denver must file every quarter to report and pay the Occupational Privilege Tax imposed by the city.

Who is required to file CO Denver Occupational Privilege Tax Return Quarterly?

Any person or business that earns income in Denver, including employees, independent contractors, and business owners, is required to file this tax return if their gross receipts exceed the threshold set by the city.

How to fill out CO Denver Occupational Privilege Tax Return Quarterly?

To fill out the CO Denver Occupational Privilege Tax Return Quarterly, you must provide information such as your business name, address, total gross receipts for the quarter, and calculate the tax due based on the current rate. The form can be completed online or via paper form.

What is the purpose of CO Denver Occupational Privilege Tax Return Quarterly?

The purpose of the CO Denver Occupational Privilege Tax Return Quarterly is to collect taxes from individuals and businesses operating in the city, to fund public services and infrastructure in Denver.

What information must be reported on CO Denver Occupational Privilege Tax Return Quarterly?

The information that must be reported includes the taxpayer's name, address, occupation, total gross receipts for the quarter, and any deductions applicable, along with the calculated tax amount owed.

Fill out your CO Denver Occupational Privilege Tax Return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

City Of Denver Occupational Privilege Tax is not the form you're looking for?Search for another form here.

Keywords relevant to denver occupational privilege tax employer

Related to return to form denver

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.